Have you ever considered Long Term Care (LTC) as part of your retirement?

Some things to consider about LTC.

Pros of Long-Term Care

Peace of Mind: LTC coverage provides you and your loved ones with peace of mind, knowing that you are financially prepared for potential long-term care needs.

Preserving Assets: By having LTC insurance, you can help protect your hard-earned assets, ensuring they are not depleted by the high costs of extended care services.

Choice and Control: With LTC coverage, you have the freedom to choose where and how you receive care, whether it's in your own home, an assisted living facility, or a nursing home.

Learn more about our partner in LTC and Retirement Products

Why it's Important to Consider Long-Term Care (LTC) Now, Before It's Too Late

When it comes to long-term care (LTC), the importance of planning ahead cannot be overstated. Waiting until it's too late can have significant financial and emotional consequences for both individuals and their families.

Let's delve into an example that highlights the benefits of having LTC coverage and why considering it now is crucial.

Imagine the scenario of John and Mary, a retired couple enjoying their golden years. They have diligently saved for their retirement and have a comfortable nest egg. Unfortunately, as they age, John develops a chronic health condition that requires long-term care services.

Without LTC coverage, John and Mary are faced with several challenges. First, the high costs associated with extended care services quickly erode their hard-earned savings. They find themselves in a dilemma, forced to make difficult choices between their financial security and ensuring John receives the care he needs.

On the other hand, if John and Mary had planned ahead and obtained LTC coverage, they would have experienced a significantly different outcome.

With LTC insurance in place, they would have been able to afford quality care without exhausting their savings. This would have provided them with peace of mind and the ability to focus on what truly matters: supporting John's health and well-being.

Beyond financial benefits, LTC coverage offers emotional security for individuals and their loved ones. It relieves the burden and stress of worrying about how to pay for long-term care needs, allowing families to focus on providing love and support during challenging times.

Considering LTC now, while still in good health, ensures access to a wider range of coverage options and potentially lower premiums. By taking proactive steps to secure LTC coverage, individuals can lock in favorable rates and tailor their policy to meet their specific needs.

It's important to remember that LTC needs can arise unexpectedly, regardless of age or current health status. Planning for LTC in advance ensures that you are prepared for any future eventuality, allowing you to maintain control over your care and finances.

Don't wait until it's too late to consider LTC. Take action now to protect your financial security, ease the burden on your loved ones, and ensure a higher quality of life in your later years.

If you have questions or need assistance with LTC planning, feel free to reach out.

We're here to provide guidance and support in securing your future.

In Good Hands For A Good Future.

We can help you with your retirement plans.

Cons of Long-Term Care:

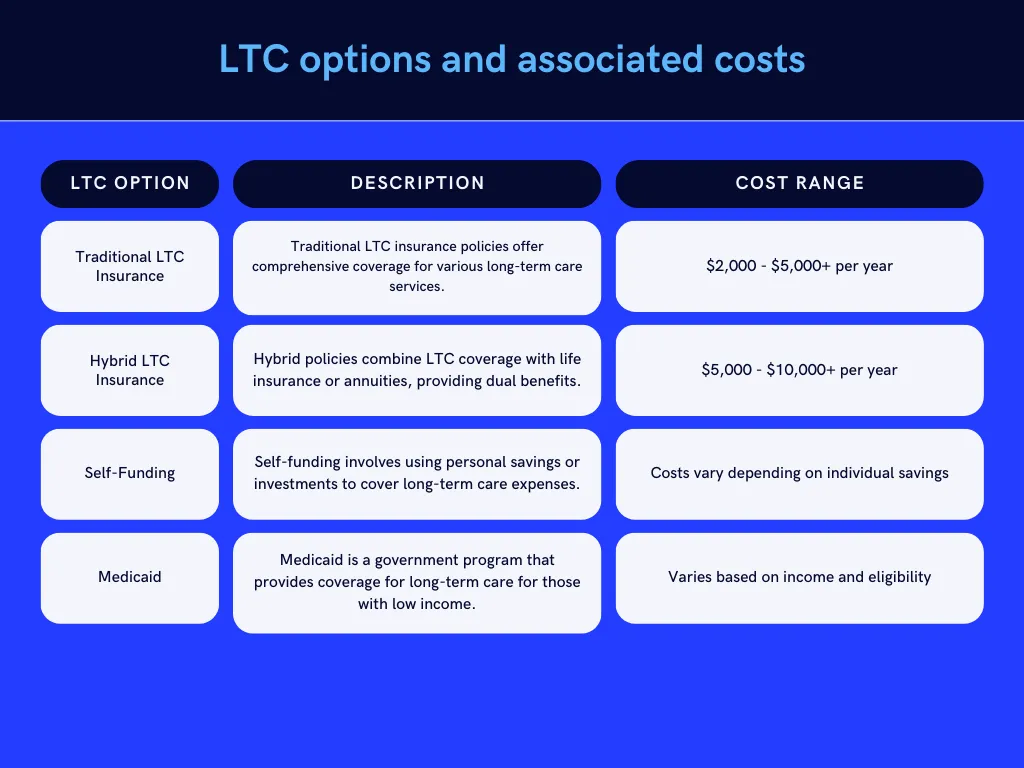

Cost: One common misconception is that LTC is expensive. While premiums can vary, they are typically more affordable when purchased at a younger age. Comparatively, the potential costs of long-term care services without insurance coverage can be significantly higher.

Underutilization: Some individuals worry about paying for something they may never use. However, the reality is that many people require long-term care at some point in their lives, and having LTC coverage ensures you are prepared when the need arises.

Have you Heard of RMD?

As a retiree, you may have heard of the term Required Minimum Distribution (RMD) before. It refers to the minimum amount you must withdraw from your retirement accounts, such as 401(k)s and IRAs, once you reach the age of between 73-75. Failure to take the RMD could result in a hefty tax penalty, so it's crucial to know what you're dealing with.

This event is specifically designed for You!

We know that you care about your clients financial plans.

We like to help with the long term plan or the Macro view of their future plans.

Alexander Rascionato offers Investment Advisory Services through Gradient Advisors, LLC (Arden Hills, MN 877-885-0508)

, an SEC Registered Investment Advisor. Gradient Advisors, LLC and its advisors do not render tax, legal, or accounting advice. CMA Wealth Management is not a registered investment advisor and is independent of Gradient Advisors, LLC. Insurance products and services are offered through Alexander Rascionato, independent agent. CMA Wealth Management, Alexander Rascionato and Gradient Advisors, LLC are not affiliated with or endorsed by the Social Security Administration or any government agency. All written content on this site is for information purposes only. Opinions expressed herein are solely those of Albert Naticchioni, and our editorial staff. The presence of this website shall in no way be construed or interpreted as a solicitation to sell or offer to sell Investment Advisory Services to any residents of any State other than the State(s) Alexander Rascionato, is registered or where otherwise legally permitted. Material presented is believed to be from reliable sources; however, we make no representations as to its accuracy or completeness. All information and ideas should be discussed in detail with your individual adviser prior to implementation. Hyperlinks on this website are provided as a convenience. We cannot be held responsible for information, services or products found on websites linked to ours.

Copyright © 2022 Gradient Positioning Systems, LLC | All Right Reserved.